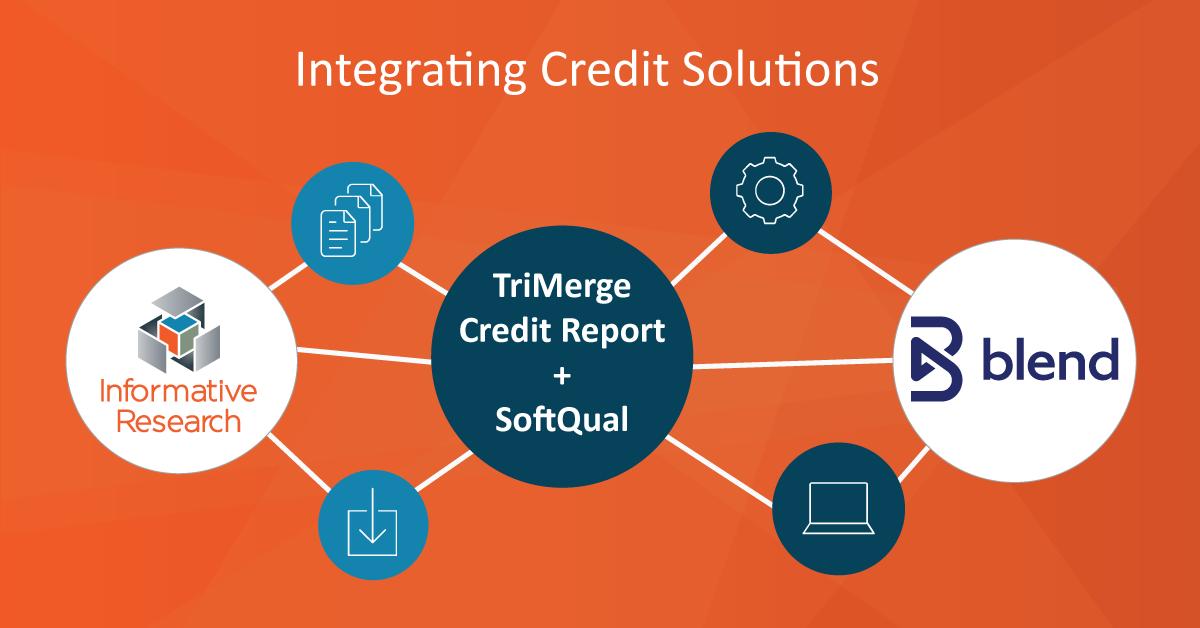

Informative Research is excited to announce its integration with Blend, a leading digital lending platform. With this integration, lenders will be able to order Informative Research’s TriMerge Credit Report and SoftQual solutions directly on the digital platform.

“Our goal at Informative Research is to get our clients as close to a true digital loan process as possible,” stated Matthew Orlando, Head of Client Success and Strategy. “Our integrations ensure that lenders have access to the products they need to speed up the process. Integrating with Blend is a huge step for offering clients that improved digital loan experience.”

Through Blend, users can order Informative Research’s comprehensive TriMerge Credit Report, along with their popular SoftQual product, which will be available soon on the platform. SoftQual is Informative Research’s pre-qualification solution that lets lenders pull a soft inquiry on an applicant’s credit report before pulling a hard inquiry. Through prequalification, lenders can save up to 70% on upfront credit costs and avoid getting their leads poached.

“Blend is always looking for ways to better serve our customers by offering lenders more options to streamline the process for consumers,” said Brian Martin, Head of Business Development at Blend. “We’re thrilled to offer this direct integration with Informative Research because it makes the process simpler and faster for lenders while driving more closed loans and reducing costs.”

For more information, contact us today!

About Blend

Blend makes the process of getting a loan simpler, faster, and safer. With its digital lending platform, Blend helps financial institutions including Wells Fargo and U.S. Bank increase productivity and deliver exceptional customer experiences. The company regularly processes more than $2 billion in mortgages and consumer loans daily, helping millions of consumers get into homes and gain access to the capital they need to lead better lives. To learn more, visit blend.com.