Need credit score tips to help your borrower? Read below for the best ways to help them qualify!

The Basics

What is a FICO Score?

A Fair Isaac (FICO) credit score can be generated for anyone with at least one reported credit tradeline in the past 12 months and is based on data from the three credit bureaus: Equifax, Experian, and TransUnion. All three bureaus generate a separate credit score, each being slightly different due to data variances in the consumer profile.

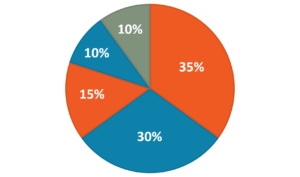

Payment History (35%): late payments, tax liens, bankruptcies, etc.

Accounts Owed (30%): outstanding balances on accounts

Length of Credit History (15%): the longer your history, the better

New Credit (10%): inquires/applications for new credit accounts

Credit Mix (10%): the mix of credit cards, retail accounts, loans, etc.

Tips for Helping Your Borrower Increase Their FICO Score

- Check the name, address, SSN, and all public records entries on the report for accuracy

- Make sure all the tradelines show up only once and belong to the borrower

- Confirm the existing balances, review past payments, and update significant recent payments

- Use Credit Assure to automatically see the increased score your client could potentially achieve

- Allow negative data to pass important time thresholds (e.g. 6 to 12 months)

- Find out which actions will have the most positive impact using the CreditXpert Wayfinder tool

- Have your borrower reduce outstanding balances with cash payments to lower credit utilization

- Before committing to anything, use custom or predefined scenarios within IR’s CreditXpert What-If Simulator to see how your borrower’s FICO score would change

3 Common Myths on Credit Scores

MYTH: Paying off credit cards, collection accounts, tax liens, etc. will always increase the FICO score

FACT: The FICO model score reflects updates from “Date of Last Activity,” so paying off an old collection account can count against your borrower

MYTH: Closing accounts with zero balances will increase the FICO score

FACT: Closing accounts can raise the overall credit utilization, which can end up decreasing the FICO score

MYTH: Public records, judgments, liens, etc. negatively impact the FICO score forever

FACT: Most are removed from a credit file after 7 years (10 years in California)

How Do I Correct Errors?

- With proper documentation from your borrower, use IR’s Credit Rescore service to update any errors and get a new credit report in as soon as 24 hours

- The borrower can contact the credit bureaus directly to correct any errors

- Informative Research can initiate a credit dispute process with the bureaus on behalf of the borrower free of charge; this usually takes 30-40 days

Did You Know?

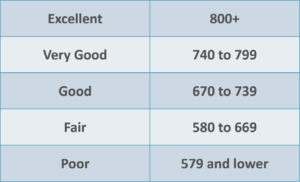

> FICO scores can range from 300 to 850 under the following categories:

>> Our CreditXpert Solutions Suite can improve your borrower’s score by up to 50 points:

Credit Assure™

Automatically scans the credit report and shows you the increased score that your client could potentially achieve

Wayfinder™

Determines the best actions to take so you and your client know how to increase their credit score

What-if Simulator™

Before taking action, easily plug in custom or predefined scenarios to predict how the score would change

FAQ

What are some positive and negative impacts on a credit score?

Positive

Paying bills on time

Low balances compared to maximum credit available

Positive credit management over the past 2 years

Negative

Delinquent payments and collections

Opening too many accounts in a short period of time

High total outstanding debt and derogatory public records

How do mortgage lenders use a credit score?

Lenders use credit scores to predict how likely a borrower is to repay a new debt based on past credit behavior. FICO scores are also used to determine the type of mortgage, costs, and interest rates.

Why do scores obtained by the consumer often differ from those on a lender’s credit report?

There are no regulations that state a specific score must be displayed to the consumer, so different entities can choose which score they want to display from the multiple bureau options available to them. On the other hand, lenders are required to pull a specific score for mortgage lending so there’s consistency when making a lending decision.

What causes a “No Score” from one or more of the bureaus?

There could be 3 main causes:

- There’s not enough information in the borrower’s credit report to calculate a score

- The borrower’s file has not been updated by a creditor within the last 6 months

- 2 out the 3 identifying elements to access the file don’t match the bureau’s database