Credit reports aren't the easiest piece of information to read and it's a layout that the industry isn't going to revamp any time soon.

Luckily, our credit reports are designed to be simple to review and interpret. We’ve accumulated numerous formats because we continue to create custom layouts that fit our client’s unique needs (because every partner is different).

Because each credit report contains a vast amount of data we can separate sections and customize their order within a report so your underwriters can make informed lending decisions more efficiently. Our credit reports can be ordered on Web Credit System or through your LOS. For our current LOS Integration Status please email info@informativeresearch.com.

Learn more about the different report sections by clicking on the title:

- Report Header

- Borrower & Co-Borrower

- Employment

- Tradelines & Collections

- Credit Inquiries

- Public Records

- FICO Score

- Credit Assure

- Credit Data Repository

Click here to download a PDF version!

Download a sample of:

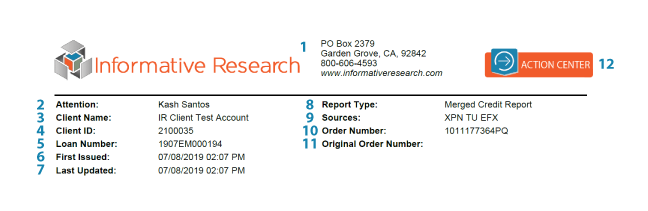

Report Header

- Informative Research Address

- Loan Officer Name

- Company Name

- Your Informative Research Client ID

- Loan Number

- The date the report was first issued

- The date the report was last updated

- Type of report

- Which bureaus the data is coming from

- The current order number

- The original order number, if applicable

- ACTION CENTER: instantly check the status of your supplement and rescore orders and reset the duplicate flag on a credit report

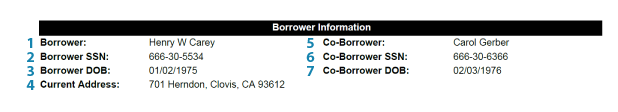

Borrower/Co-Borrower Information

- Borrower’s name

- Borrower’s social security number

- Borrower’s date of birth

- Borrower’s current address

- Co-Borrower’s name

- Co-Borrower’s social security number

- Co-Borrower’s date of birth

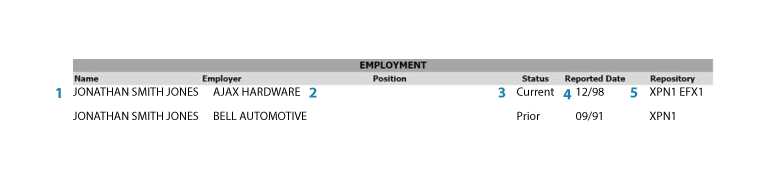

Employment

- Borrower’s name

- Name of the employer

- Status of their employment

- Date the employment was reported to the bureaus

- The bureau supplying the employment data

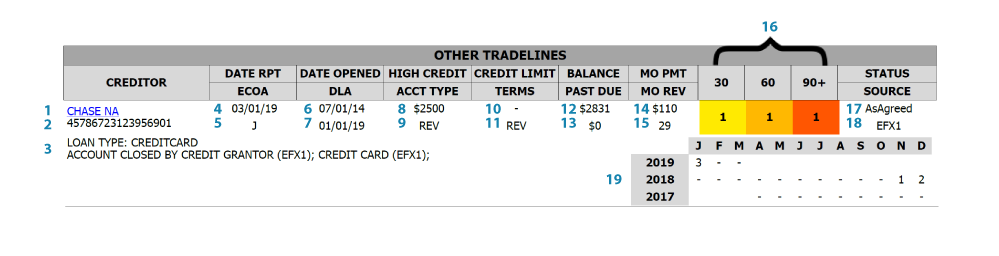

Open Tradelines & Collections

- Creditor’s name

- Account number

- Comments from the bureau on the account

- DATE RPT: Date the tradeline was reported to the bureaus

- ECOA: the relationship of the tradeline to the borrower(s)

- DATE OPENED: the date the account was established

- DLA: date of the last activity on the account

- HIGH CREDIT: historical high credit balance of the account

- ACCT TYPE: type of account by code

- CREDIT LIMIT: reported high credit limit for the account

- TERMS: term of repayment granted by the creditor

- BALANCE: outstanding amount on the account

- PAST DUE: amount that’s past due

- MO PMT: monthly payment for the account

- MO REV: number of months the account has been reviewed

- Number of times payment has been late for the indicated time frames

- STATUS: current status of the account as of the Date Reported

- SOURCE: the bureau supplying the tradeline data

- Payment history over the last 3 years

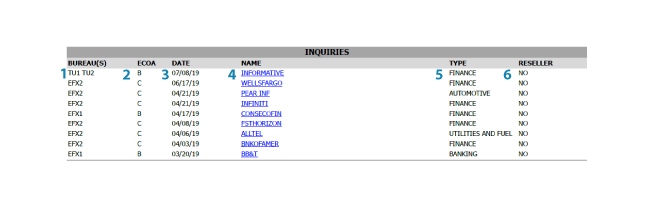

Credit Inquiries

- Bureau associated with that inquiry

- ECOA code – relationship of the inquiry to the borrower

- Date of the inquiry

- Name of the agency

- Type of inquiry

- Indicates whether or not that agency is a reseller

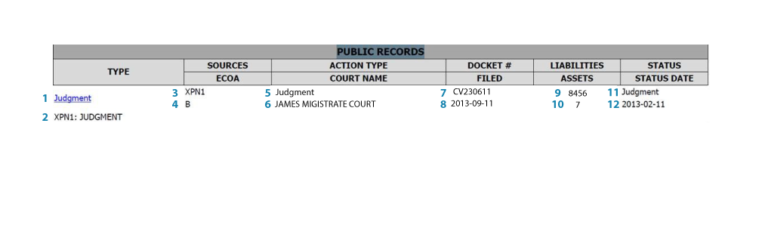

Public Records

- Type of record

- Description of the record type

- Bureau providing the record data

- ECOA: relationship of the record to the borrower

- ACTION TYPE: the type of case filed

- COURT NAME: court where the record was filed

- DOCKET #: the docket or case number associated to the record

- FILED: the date the record was filed

- LIABILITIES: number of liabilities associated to the case

- ASSETS: number of assets tied to that record

- STATUS: current status of the record

- STATUS DATE: date of the latest status

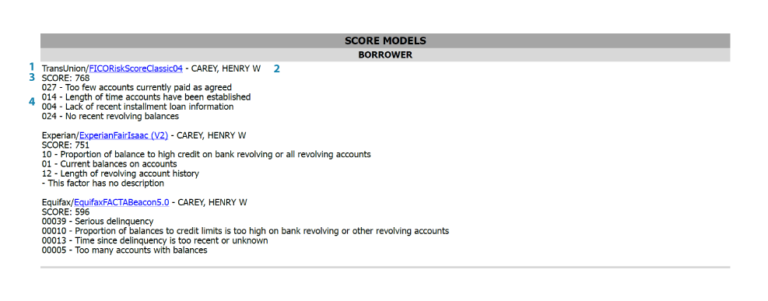

Credit Scores

- The name of the bureau and score model

- Borrower’s name

- Credit score

- The top 4-5 factors that negatively affected the given score

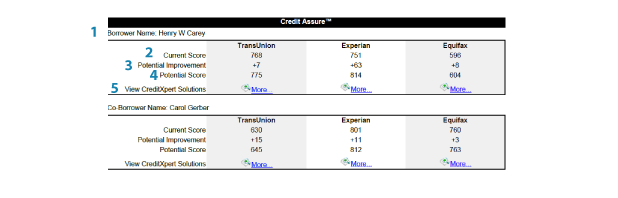

Credit Assure

- Name of the borrower

- The borrower’s current credit score

- The potential improvement of the current score

- The potential score that the borrower could have

- Link to see the solutions to help improve the borrower’s score

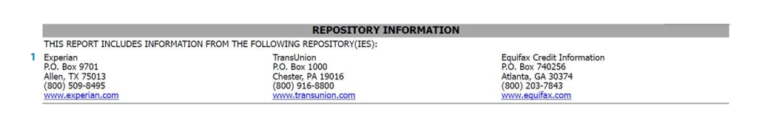

Credit Repository Information

1. Name, address, website, and phone number for all three credit bureaus